Best Finance Apps

People often complain about how they don’t have enough money. However, some of these are just cases of mismanagement of finances. A few good practices, tips, and guidelines can help many people live well beyond their means.

There are several apps right now that can help out a variety of financial issues. From budgeting to various issues, there is an app for each one.

Let’s check out several of the best finance apps.

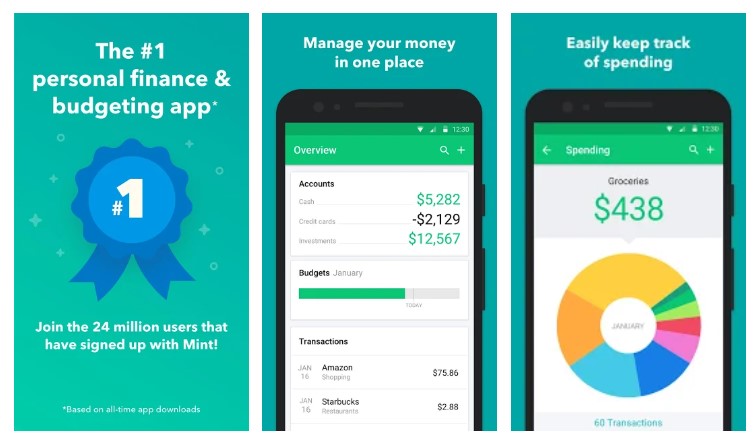

Mint

Mint is a great app for people’s overall finances. It basically grants an overview of all your finances in one simple space.

For ease of use, you can link your credit card and debit cards here. This means that the financial information in your accounts is reflected in real-time.

If you transact with any of these accounts, these transactions are pulled and placed in the app. You can easily see where your money is going and how you are spending it.

Mint also allows you to create budgets and track down any bills that you are paying.

Other features include scheduled payments for utilities, tracking of investments, the ability to view your credit score, and understanding the factors that have contributed to your credit score.

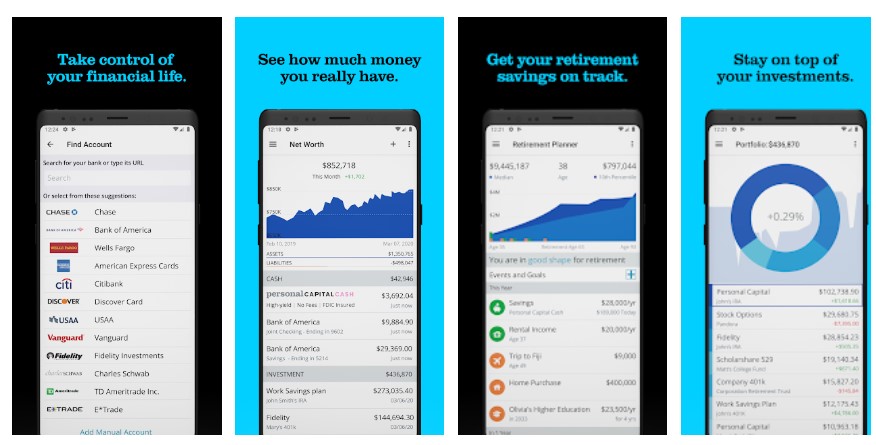

Personal Capital

Personal Capital is a finance app that is best utilized for people’s investments. With this app, you can manage your assets and investments.

The app is partnered with more than 14,000 financial institutions. Your accounts can be linked here for visibility and tracking of spending.

However, this app really shines with personal investments. Track your portfolio, discover diversification opportunities, see risk management, and most importantly, see if there are any hidden fees being charged to you.

You can also compare your portfolio to those of major market benchmarks, allowing you to see how your investments are growing.

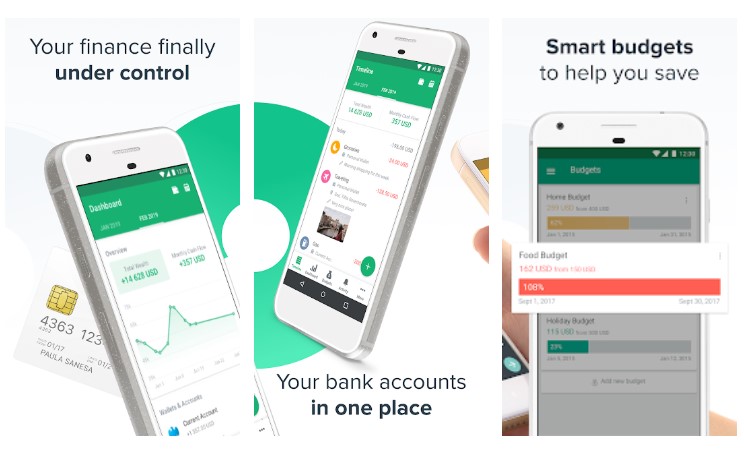

Spendee

Next up is Spendee. Spendee is very specific in its use. It is catered towards people, couples, or families that have shared spending accounts or budgets.

Within the app, you’ll be able to create shared wallets. You can also import bank transactions, with the app doing most of the heavy lifting in terms of categorizing. Manually adding transactions is also possible.

If there is a specific event coming up, you can create an event that helps you track your budget for it.

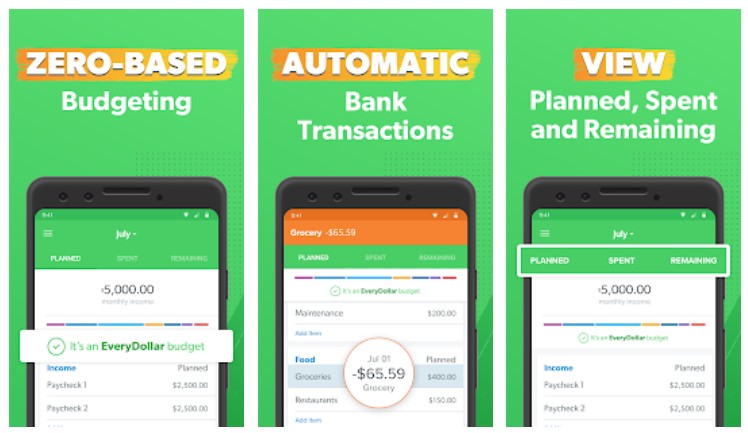

EveryDollar

Let’s move on to EveryDollar. This app takes financial expert Dave Ramsey’s “zero-based budget” philosophy. The philosophy goes that every dollar is important. That is why the app is named that way.

Standard features are included here. Things like budgets, spending tracking, and importing bank transactions are available.

One of the best features of this app though is the ability to connect with a multitude of financial experts. These experts can then assist you in planning your finances.

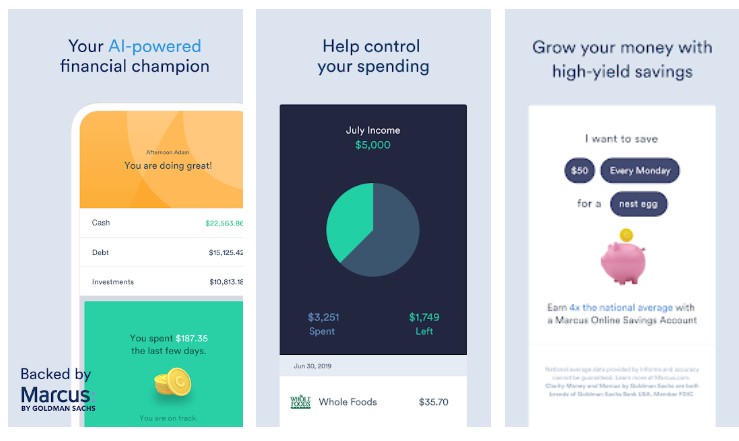

Clarity Money

A clear picture of your finances is very important in trying to save and earn more. The Clarity Money app caters to a specific part of people’s lives that they didn’t know they had to monitor.

This part is the many subscriptions that we all have in our lives now. Netflix, Spotify, Amazon Prime, and so many others. These are subscriptions that routinely charge people every month.

With the Clarity Money app, you can easily keep track of these subscriptions. You can also use this app to help stop or cancel any unwanted subscriptions.

It also has standard financial management functions like budget tracking and attaching a goal to your savings.

These financial apps are a great way of improving your finances. Find the right financial management app for you and take on the lessons that they have to teach you.

Looking for another mobile app? Click here!